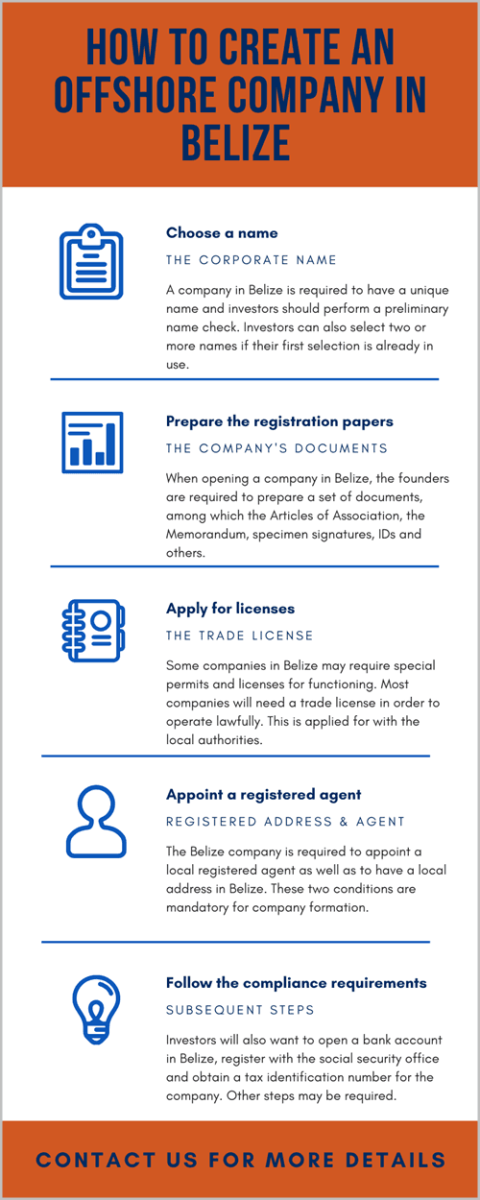

How Offshore Company Formation Can Boost Your Business in Global Markets

How Offshore Company Formation Can Boost Your Business in Global Markets

Blog Article

Top Factors to Take Into Consideration Offshore Company Formation for Your Service

Offshore firm formation presents a critical method for businesses aiming to improve their functional performance and financial performance. Secret factors to consider consist of possible tax advantages that can significantly improve profit margins, together with robust possession defense devices that shield personal riches from service threats. In addition, the privacy features intrinsic in many offshore jurisdictions provide an added layer of safety for possession information, while the versatility in organizational framework can bring about more nimble decision-making processes. As business navigate the intricacies of global markets, the inquiry remains: what particular benefits might an overseas framework attend to your one-of-a-kind business needs?

Tax Obligation Benefits

Regularly, companies take into consideration offshore company development as a tactical transfer to enhance their tax responsibilities. Establishing an entity in a low-tax territory can cause substantial economic advantages. Many overseas locations supply desirable tax obligation routines, including no or dramatically decreased company taxes, which can greatly enhance a firm's profits.

Furthermore, the potential for tax deferment is an additional attractive function of overseas firm formation. By maintaining earnings within the overseas entity, companies can postpone tax obligation commitments until funds are repatriated. This deferral can supply liquidity for reinvestment and development opportunities without the immediate problem of taxes.

Nevertheless, it is important for firms to navigate the intricacies of worldwide tax obligation legislation thoroughly. Conformity with policies in both the home nation and the offshore territory is vital to avoid charges and ensure the sustainability of tax obligation advantages. As a result, professional support is advised to maximize these advantages properly.

Possession Defense

In addition to tax benefits, overseas firm formation works as an efficient approach for possession security. By developing a business entity in a jurisdiction with positive legislations, business owners can shield their individual assets from prospective risks related to their business operations - offshore company formation. This approach is especially valuable for those in risky industries, where the possibility of claims or financial institution claims might be increased

Offshore territories frequently give lawful frameworks that restrict creditor access to the properties held within the firm. Several overseas companies offer minimal liability defense, suggesting that the proprietors are not personally liable for the financial debts and commitments of the service. This separation can protect individual residential or commercial property, such as financial savings and homes, from being targeted in lawsuits.

Additionally, making use of offshore structures can aid in securing assets from economic or political instability in one's home nation. By branching out asset holdings throughout borders, business proprietors can create a barrier against undesirable changes in residential legislation or market problems.

Enhanced Personal Privacy

Enhanced personal privacy is a significant advantage of offshore business development, attracting several entrepreneurs looking for to safeguard their individual and business details (offshore company formation). By establishing an overseas entity, entrepreneur can protect their identifications check over here from public examination, as several jurisdictions use strict privacy regulations that limit the disclosure of explanation business possession and financial information

In several overseas areas, the requirement for public computer system registries is minimal, enabling confidential ownership frameworks. This means that sensitive info, such as the names of directors and investors, is not conveniently accessible to the public or completing organizations. Because of this, entrepreneurs can run with a reduced risk of undesirable focus, shielding their operational details and proprietary methods.

In addition, the enhanced privacy related to overseas firms can discourage prospective baseless inquiries and legal disputes, offering a buffer against frivolous suits or aggressive competitors. This level of personal privacy can be especially helpful in markets where keeping privacy is vital for affordable advantage.

Company Flexibility

One of the most engaging benefits of offshore company development is the exceptional service versatility it provides (offshore company formation). Business owners gain from the capability to customize their organizational framework, enabling them to adapt to details functional requirements and market conditions. This adaptability includes choosing the sort of lawful entity that finest suits business objectives, whether it be a company, limited responsibility business, or partnership

Business can tailor their procedures to take advantage of regional advantages, such as he has a good point tax incentives, experienced labor, or specialized solutions. Eventually, the flexibility managed by offshore company development empowers business owners to pursue their visions with self-confidence and agility.

Access to International Markets

Frequently, overseas business development opens up unparalleled accessibility to global markets, making it possible for services to expand their reach past domestic borders. By developing an existence in a positive jurisdiction, business can use diverse consumer bases and utilize worldwide profession opportunities. This critical positioning enables them to reduce reliance on neighborhood markets, thus minimizing risks connected with regional economic variations.

Moreover, offshore entities frequently take advantage of advantageous profession arrangements and tax rewards that boost their competitive edge. Such setups can result in set you back savings, which can be redirected in the direction of further investment in advertising and marketing and product development. Services can also access sophisticated facilities, experienced labor, and ingenious modern technologies that might not be readily available in their home countries.

Final Thought

Finally, offshore firm formation offers a strategic avenue for companies looking for to enhance earnings and safeguard possessions. The advantages of reduced tax obligation worries, robust possession defense, and heightened personal privacy add to a more safe and reliable functional structure. Additionally, the versatility in business structures and access to worldwide markets equip firms to navigate diverse economic landscapes successfully. As a result, the factor to consider of overseas firm development becomes an engaging option for those aiming to optimize company performance and development possibility.

Offshore business formation provides a tactical opportunity for companies intending to improve their functional effectiveness and monetary performance.Frequently, businesses consider offshore firm development as a critical step to maximize their tax obligation obligations.One of the most compelling benefits of offshore company development is the exceptional company adaptability it supplies.Frequently, overseas business formation opens up unparalleled accessibility to worldwide markets, enabling organizations to broaden their reach beyond residential borders.In verdict, overseas company development presents a critical avenue for organizations seeking to boost success and safeguard assets.

Report this page